HELB offer a solution to students seeking help to pay for higher education. They are offered by the government of Kenya through the higher education loans board. These loans are supposed to cater for post-secondary education. There are different types of HELB loans depending on the applicant:

- Undergraduate loans: Loans for students pursuing diploma and degree programs in recognized colleges and university.

- Postgraduate loans: Loans for postgraduate students pursuing masters and Phd programs locally and abroad.

- TVET loans: Loans for students in technical and vocational institutions.

- Afya Elimu loans: Loans for students pursuing medical courses.

- Jielimishe loans: Loans for salaried students who want to advance their studies through a degree or diploma program

Who Qualifies for an HELB Loan?

- Kenyan citizen – This loan is only available to Kenyan students. You must prove that you are a Kenyan citizen to access the loan

- Proof of university/college admission – Since this loan is meant to pay for higher education, you must provide proof of admission to recognized university or college.

- Genuine financial need – The HELB loan is supposed to take care of needy students. It is advisable to show that you need the money by providing all the necessary financial details.

- Meet minimum academic qualification – It is advisable to have the minimum academic qualification needed to pursue the course of study.

- Good repayment history – If you had previously applied for an HELB loan, you should have a good repayment history. If you are in good standing, you will definitely receive a new loan.

If you have met all the qualifications, it is time to move to the HELB portal and start the registration process.

What Documents Do you Need for HELB Registration?

- National identification card to ascertain that you are a Kenyan citizen

- Letter or admission from university, college or TVET institution to confirm admission

- Information about income which includes any document that shows that you qualify for the loan based in the financial situation.

- Guarantee to pay the loan in case you default. Add their personal and contact information

- Passport-sized photograph for physical identification

- Bank details for depositing the money once it is disbursed

- Academic details to prove that you qualify for admission to an institution of higher learning

How to Register on the HELB Portal Student Registration

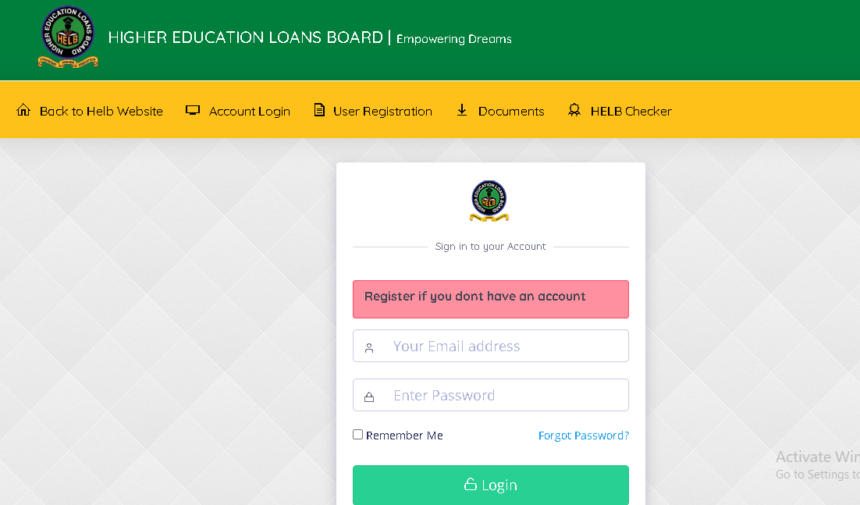

- Visit https://studentportal.helb.co.ke/auth/signin

- Click on the applicant registration option

- Fill in all the details (personal details, institutional data, financial data and contact information) note: It is a long list

- Create a user name and password

- Verify the email address

- Log-in to your account

- Take a tour and familiarize yourself with the different features on the site

HELB Loan Application Guide

By the time you are making that loan application you should have already registered an account on the portal. Since you already have an account, follow the steps below:

- Log into the help portal using the username and password you used during the registration process

- Find the loan application link and click on it.

- Accurately fill the application form with all the details required

- In case you need to submit any documents, scan and upload them in the right format.

- Review the details to make sure that everything is accurate.

- Click submit and keep checking the loan status.

How to Check HELB Loan Application Status

After making the application and submitting it, the waiting process starts. Fortunately, you can easily track the progress right from the HELB portal. Here is a guide on how to check the progress on how loan:

- Log into the HELB portal with your account details

- Click on the student portal

- Look for the loan status link or section

- Click on the application status (in progress, under review, approved or rejection)

- Find additional information such as missing documents

Clearing Errors on the HELB Portal

The HELB portal is susceptible to errors since many people visit it at a time. Here are some ways to clear the errors:

- Clearing cache – Clearing cache on the HELB website can help to get rid of the errors caused by cached data. You can always go to the settings of the browser and clear cached data.

- Refresh the page – If you experience errors, keep refreshing the page. It might be due to poor internet connection or the page might be temporarily down.

- Use a different browser – You can try switching to a different browser if the current browser is not connecting to HELB portal.

- Try later – Sometimes the portal is busy or down for some reason. Try later and see whether it works.

- Call them – In case you have been trying for days or hours without success, you might need to call HELB for additional help.

Why was my HELB Loan Application Rejected?

Inaccurate or incomplete information – Before you submit the information, make sure that you double check and review it. Your application might be rejection if you submitted untrue information or you left out some of the information. Missing signatures and stamps might also cause denial. Take time when making the loan application.

Late loan application – If you made the application late after the closing deadline, your HELB loan will not be processed.

Poor repayment history – If you have subsequent loans obligations, you might be rejected. If you did not pay the previous loan according to agreement, your new loan applications will not be approved.

You are financially capable – HELB loan is supposed to cater for the needs of needy students. If it is determined that you are financially capable, you might be rejected.

You do not meet the bare minimum qualification – Before your application is considered, you should at least meet the minimum qualifications such as being a Kenyan citizen and also meeting the academic qualifications.

What to do When your HELB Loan Application is Denied?

HELB loan denial can be frustrating but all hope is not lost. There are different ways to remedy the situation. Here is what to do in case your application is rejected:

Know Why the Loan was Rejected

HELB will always send a letter stating why they denied the loan. In case they do not send a letter, you can contact them via phone or email to try and find out. In case the loan application was denied due to not meeting the minimum qualification, the decision might be final. However, if the loan was denied because of missing or inaccurate information, you can appeal the decision.

Make an Appeal

You can make an appeal to HELB in case your loan was rejected because of missing information. When making the appeal, make sure that you include all the missing information.

Look for Other Funding Sources

If your loan application was rejected, you can still explore other methods of funding. Find other sources of funding such as scholarships and also seek help through the institution of higher learning. Some colleges and universities have scholarships for needy students.

HELB for Postgraduate Students

HELB offers loans to postgraduate students. The loan is supposed to cover postgraduate studies in local and international institutions of higher learning.

Who Qualifies for the Loan?

To qualify for the HELB postgraduate loan, you should meet the minimum qualifications such as being a Kenyan student, academic qualification and financial needs qualification.

What Type of Loan do Postgraduate Students Get?

The loan offered by HELB can cover both local and international studies. It is meant to cover tuition, research feed and any other associated fees. There is no specific amount allocated but it depends on the eligibility and needs of the student.

The application process for postgraduate students is similar to the undergraduate students. It starts with creating an account and filing in the application form.

Online HELB Repayment

It is advisable to start repaying your HELB loan within one year after graduation. Fortunately, you can do that right from the website. If you applied for your HELB loan after 2014, you definitely have an HELB account. Start by logging into the account. Here are some steps to start paying your HELP online:

- Log into your HELB account

- Go to the loan repayment section on the dashboard

- Choose your preferred payment method (bank, mobile money or debit card)

- Enter payment details depending on your preferred payment method

- Complete the repayment process

- Monitor the repayment status and account balance regularly

- You can get a statement regularly to check the details

If you have a huge repayment balance you can always get waiver. HELB offers yearly waivers for students with penalties. This helps to offset the balance by taking off the huge burden of penalties. HELB announces waivers regularly so you need to check for announcements.